KYC And CIP Certification

Federal regulations require collection and verification of specific identity information from merchants. These regulations are designed to prevent the misuse of financial systems and prevent financial crimes such as money laundering and terrorist financing. This document describes the information merchants are required to provide before they can become our customer and have any funds settled by WePay.

When designing your merchant onboarding flow, Clear gives you flexibility through our RESTFul API. However, the below requirements will impact the user experience you design. These requirements stem from the federal regulations described above, and must be demonstrated to WePay before you go live.

Merchant Information

The following information must be collected from each merchant. When designing your Merchant Onboarding flows, think about finding the balance between collecting the necessary information below thoroughly, while not overwhelming the merchant. Find examples of WePay's onboarding flow here.Merchant Information includes:

- Merchant Entity Type

- Business Name

- Government Identification Number

- Merchant Address

- Description of Merchant

- Merchant Website

- Merchant Phone Number

- Controller Information

- Beneficial Owner Information

- Publicly Traded Status

The requirements and specifics of each are detailed below:

Merchant Entity Type

The charts below show different entity types and descriptions. Each merchant must select one entity type in the applicable country. Your platform must enable each merchant to choose between all entity types listed below, unless stated otherwise. Contact api@wepay.com, your account manager, or your integration engineer if your platform does not support any of the below entity types.Note: Depending on the entity type chosen, the information your platform must collect for each merchant will differ.

| Entity Type | Description |

|---|---|

| Sole Proprietor | - Merchant is the sole owner of an unincorporated business. - Merchant may have an EIN (US) or Business Number (Canada). Note: In the United States, merchant that chooses entity type sole proprietor must be given a choice to enter an EIN with the last four of their Social Security Number or no EIN with their full Social Security Number. See below for more information. |

| Corporation | - Business has an EIN (US) or Business Number (Canada). - Business is incorporated. |

| LLC | - Business has an EIN (US) or Business Number (Canada). - Business is registered with the government as a Limited Liability Company. |

| Partnership | - Business is registered with the government as a partnership. - Business has an EIN (US) or Business Number (Canada). - Business is formed under a partnership agreement. |

| Nonprofit Corporation | - Nonprofit has an EIN (US) or Business Number (Canada). - Nonprofit is incorporated. Note: Platform should not allow for-profit corporations to choose this entity type. |

| Unincorporated Association | - Nonprofit has an EIN (US) or Business Number (Canada). - Nonprofit is not incorporated. Note: Unincorporated associations are a type of nonprofit. Platform should not allow for-profit corporations to choose this entity type. |

| Government Entity | The merchant is collecting funds on behalf of a US government entity. The Legal Entity does not have a controller, but rather an account controller who is an authorized representative to manage the merchant account. |

Once a merchant selects their type, send it in the API on a

POST /legal_entities or POST /legal_entities/id request in either the entity_country_info.US.legal_form or the entity_country_info.CA.legal_form parameter. If the merchant type selected inherently has a government-issued identification number, collect it and send it on the same call in either the entity_country_info.US.employer_identification_number or the entity_country_info.CA.business_number parameter. For example, a request for an onboarding US-based LLC would look like this:{

"entity_country_info": {

"US": {

"employer_identification_number": "123211230",

"legal_form": "limited_liability_company"

}

}

}Business Name

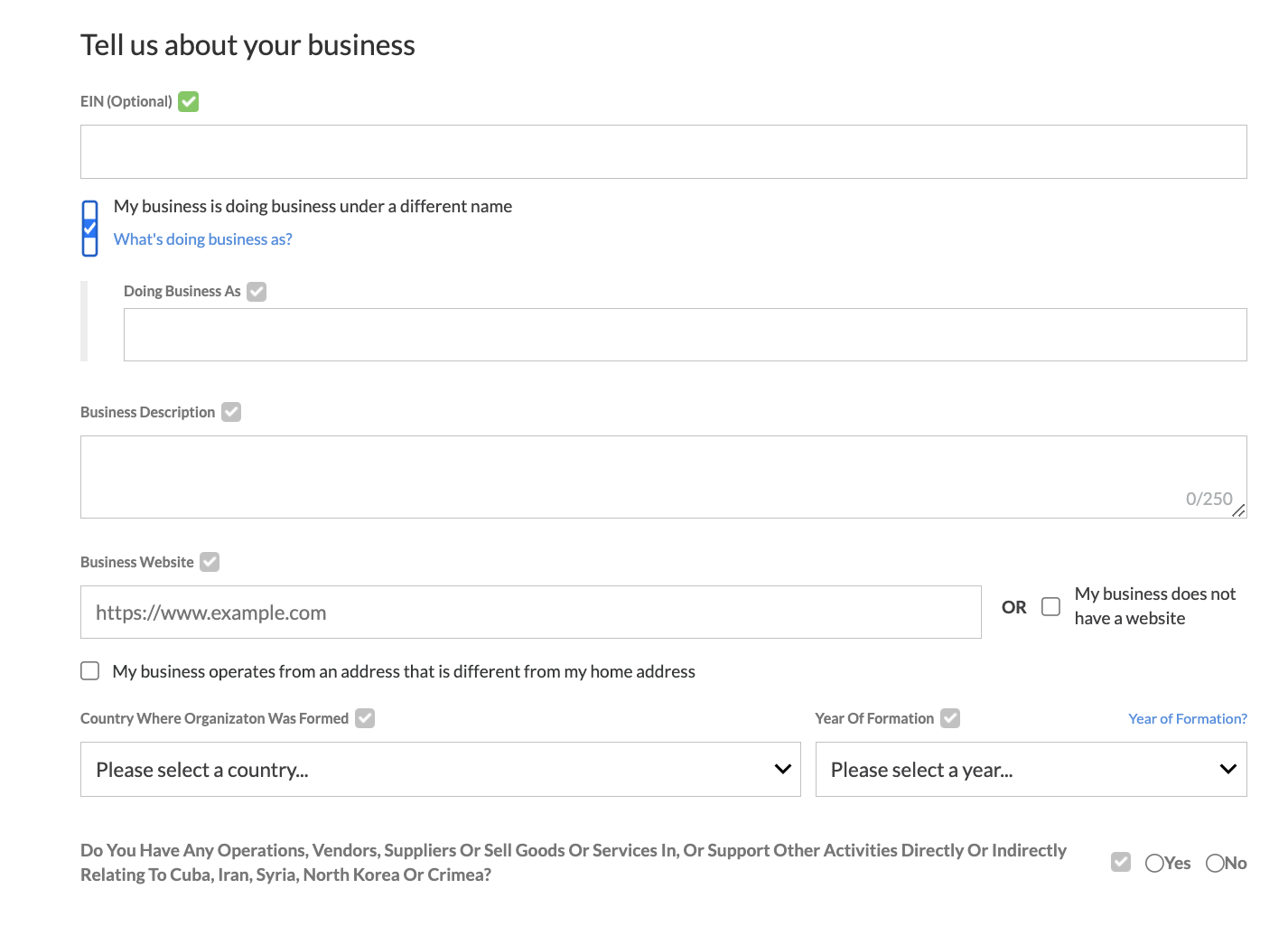

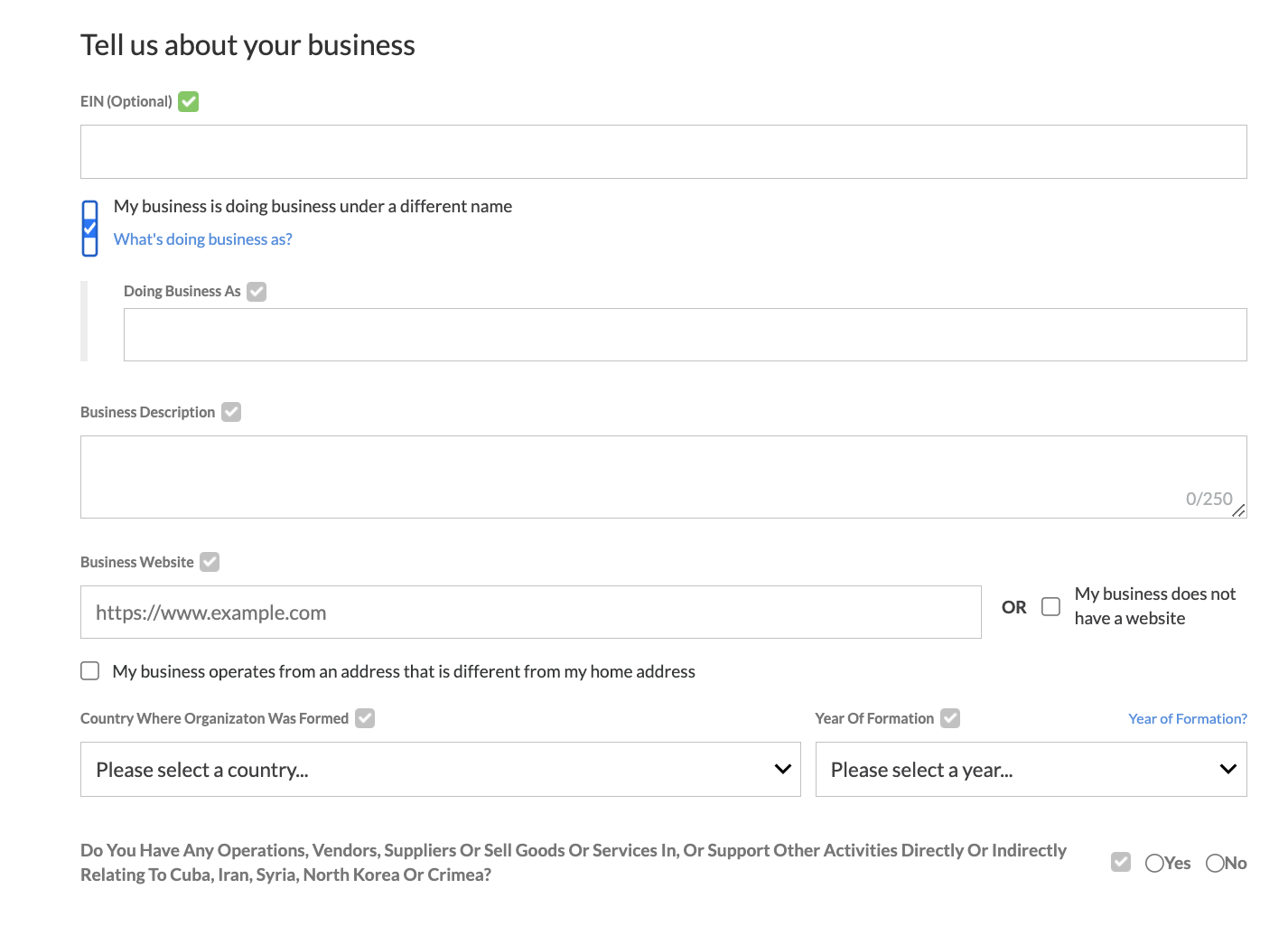

Your platform must require your merchant to provide the legal name of its business. For sole proprietors, your platform should ask whether they have a DBA, and require the sole proprietor to provide one if they have a DBA.

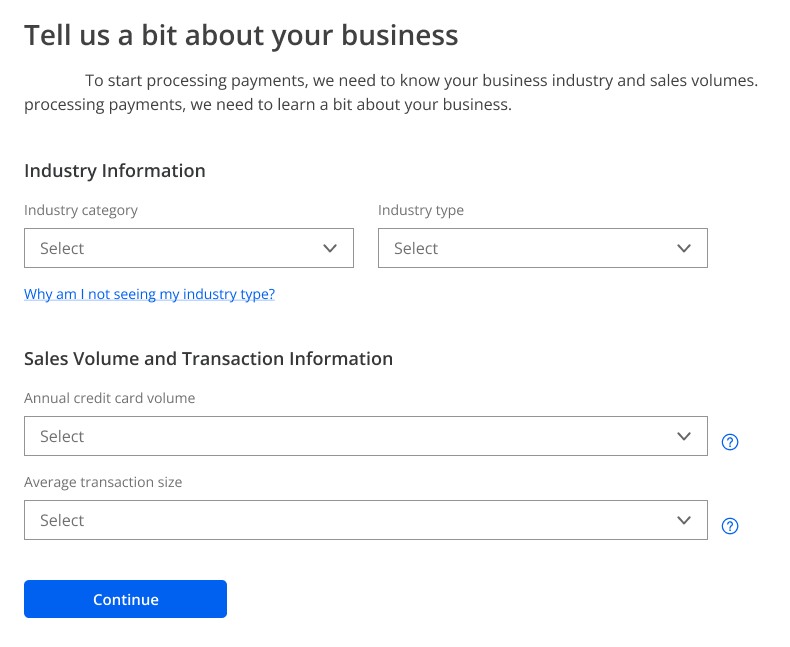

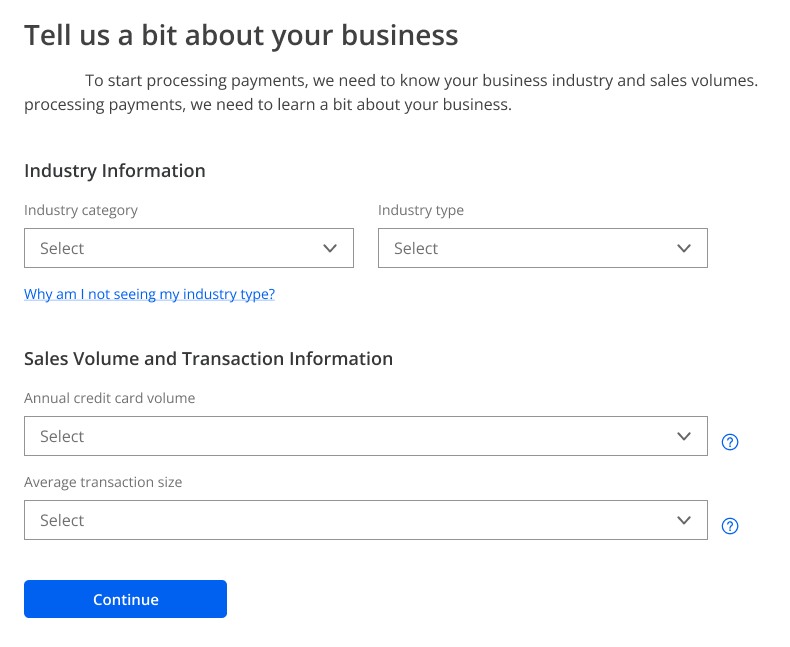

Once a merchant provides their legal business name, send it in the API on aPOST /legal_entities or POST /legal_entities/id request in the entity_name parameter.Upfront Underwriting

If Upfront underwriting is enabled, the upfront underwriting process will trigger once merchants submit their annual sales volume, average transaction size (average ticket size), and annual credit card volume. Upfront underwriting is the process by which WePay evaluates the potential risk exposure of a business by gathering additional information from the merchant to calculate and predict the chargeback rate, refund rate, and non-delivery risk of goods and services in addition to calculating our dollar value of credit exposure. This is an upfront assessment of our risk exposure before enabling payment and payout capabilities. Underwriting only occurs once. After a merchant is underwritten, any updates will not result in another underwriting. Payment processing capabilities will default to disabled until upfront underwriting is complete.

To check the status of upfront underwriting, call theGET/accounts/id/capabilities endpoint. If underwriting is still in review, payments.current_issues.issue_type will have a value ofunderwriting_not_completed.To learn more, please contact your integration team or technical account manager for more information.

Government Identification Number

The charts below summarize the required government identification numbers that need to be provided.

| Entity Type | Required identification number | Parameter |

|---|---|---|

| Individual | - Full Social Security Number (SSN9) - CAN: Social insurance number (Optional) | - US: controller.personal_country_info.US.social_security_number_last_four - CAN: controller.personal_country_info.CA.social_insurance_number (optional) |

| Sole Proprietor | - US: First, let the sole proprietor decide if they want to provide their full SSN (SSN9) or Employer Identification Number (EIN). If the merchant selects EIN, then they only need to provide SSN4, unless SSN9 cannot be derived from the provided SSN4. If they select to provide SSN9, then EIN is not needed. - CAN: Social insurance number (optional) or Business Number (optional) | - US SSN: controller.personal_country_info.US.social_security_number - US EIN: entity_country_info.US.employer_identification_number - CAN SIN: controller.personal_country_info.CA.social_insurance_number (optional) - CAN Federal or Provincial BN: entity_country_info.CA.business_number or entity_country_info.CA.provincial_business_number (optional) |

| Corporation LLC Partnership Nonprofit Corporation Unincorporated Association Government Entity | - US: EIN Note: Controllers and any beneficial owners must provide the last four of their Social Security Numbers. - CAN: Federal Business Number (required) - CAN: Provincial Business Number (optional) Note Canadian Legal Entities may optionally provide their CAN provincial BN, but we highly recommend collecting as merchant verification rates improve when this data point is present Note: Social insurance number is optional for controllers and any beneficial owners. | - US EIN: entity_country_info.US.employer_identification_number - CAN Federal BN: entity_country_info.CA.business_number (required) - CAN Provincial BN: entity_country_info.CA.provincial_business_number (recommended) |

Canadian Business Number Patterns

For merchants other than sole proprietors, we expect their provincial business registration number, as opposed to their federal business registration number. That said, merchants can submit any business registration number available, including federal registration numbers. Each province has a different pattern to expect, as outlined here.

| Province | Length (inclusive) | Regex |

|---|---|---|

| Alberta | 8-10 | /^(\d{8,10}|(AA\d{8}))$/ |

| British Colombia | 7-9 | /^(\d{7,8}|(A\d{7})|(AA\d{7}))$/ |

| Manitoba | 7,8 | /^\d{7,8}$/ |

| New Brunswick | 6 | /^\d{6}$/ |

| Newfoundland and Labrador | 5 | /^\d{5}$/ |

| Nova Scotia | 7 | /^\d{7}$/ |

| Northwest Territories | 5-15 | /^\d{5,15}$/ |

| Nunavut | 5-15 | /^\d{5,15}$/ |

| Ontario | 7, 8, or 10 characters | /^(\d{7,8}|\d{10})$/ |

| Prince Edward Island | 5-15 | /^\d{5,15}$/ |

| Quebec | 10 | /^\d{10}$/ |

| Saskatchewan | 9-10 | /^\d{9,10}$/ |

| Yukon | 6 | /^\d{6}$/ |

Merchant Address

Your platform must require the merchant to provide the full physical address of its business. Note a couple exceptions:

- Individuals: Since merchants with entity type

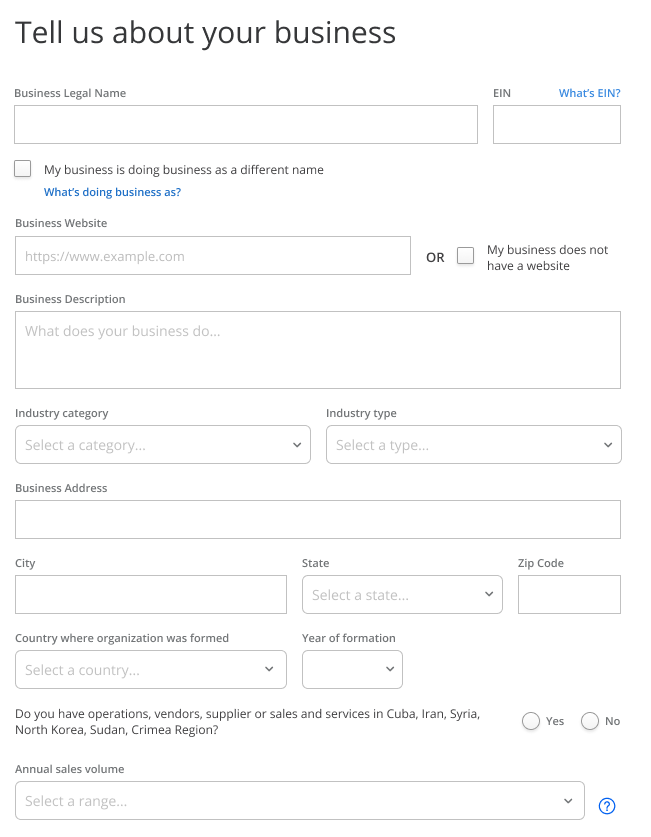

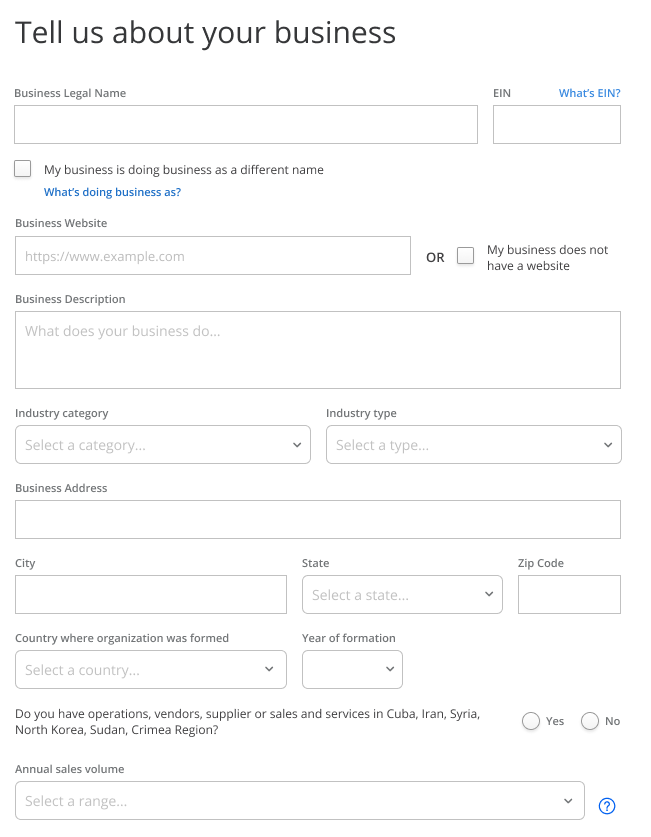

individualdo not have business operations, this field is not required for entity typeindividual. - Sole Proprietors: Your platform should only collect a separate business address from merchants with entity type 'sole proprietors' if the merchant operates its business from a different address than the merchant's home address. See examples below from WePay onboarding - the business address is only required if the merchant checks the box that the business operates from a different address than the home address:

Click for a UI example of this check box selection:

- Other Business/Nonprofit types: The business street address must be collected. Army Post Office or Fleet Post Office box numbers and descriptions of physical locations are not permitted.

POST /legal_entities or POST /legal_entities/id API request in the top level address parameter.Description of Merchant

Your platform must request merchants to provide a brief description of its nature of business or, for individuals, the purpose of the account.

Once collected, send the description on aPOST /legal_entities or POST /legal_entities/id request in the top level description parameter.Merchant Website

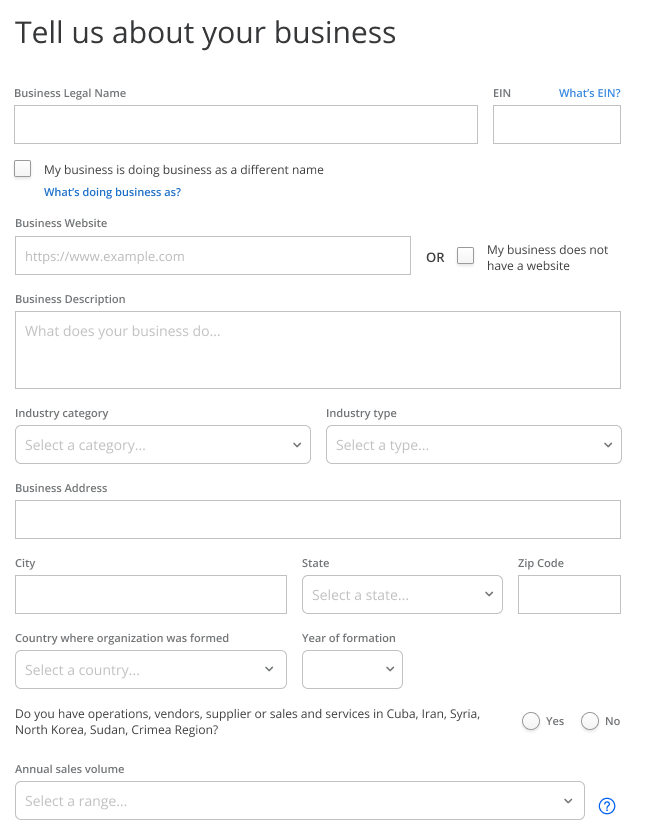

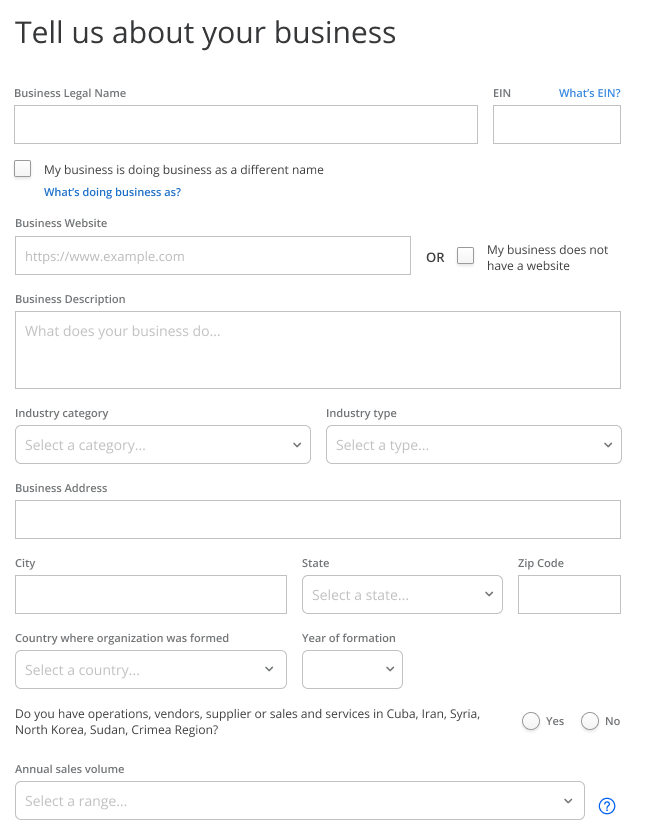

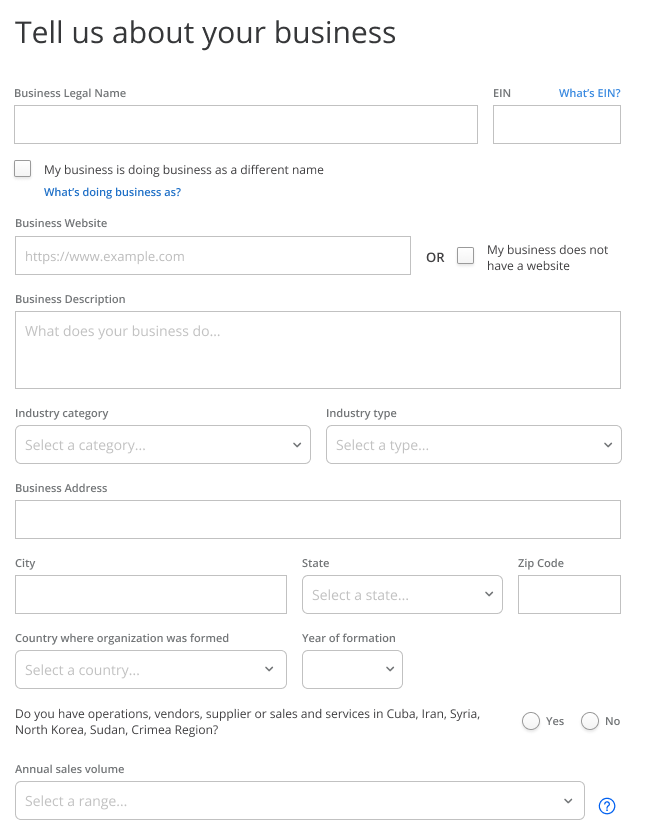

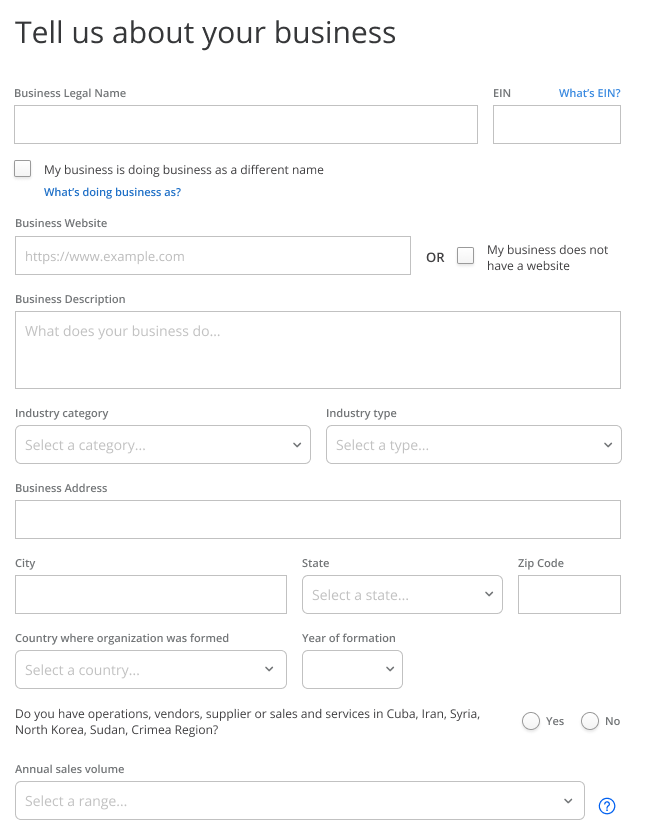

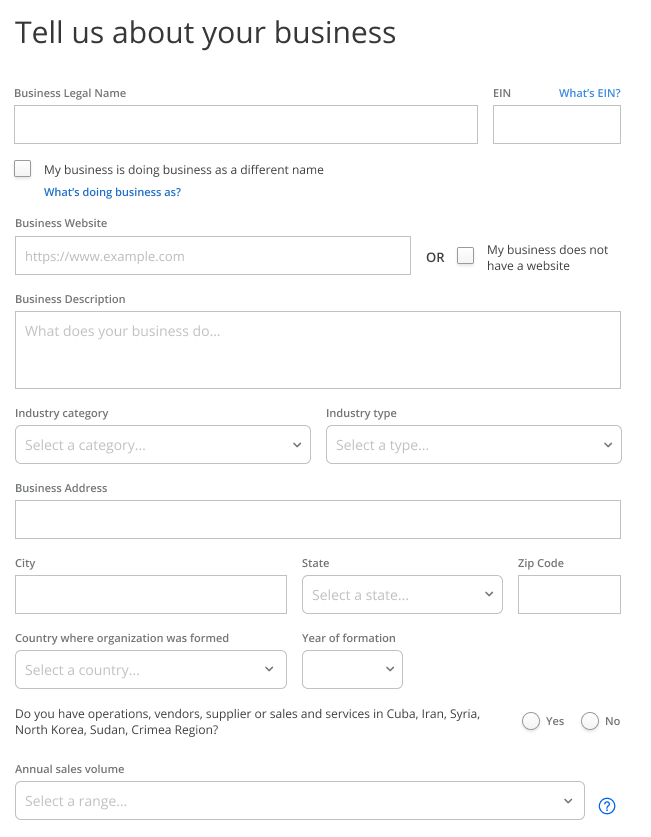

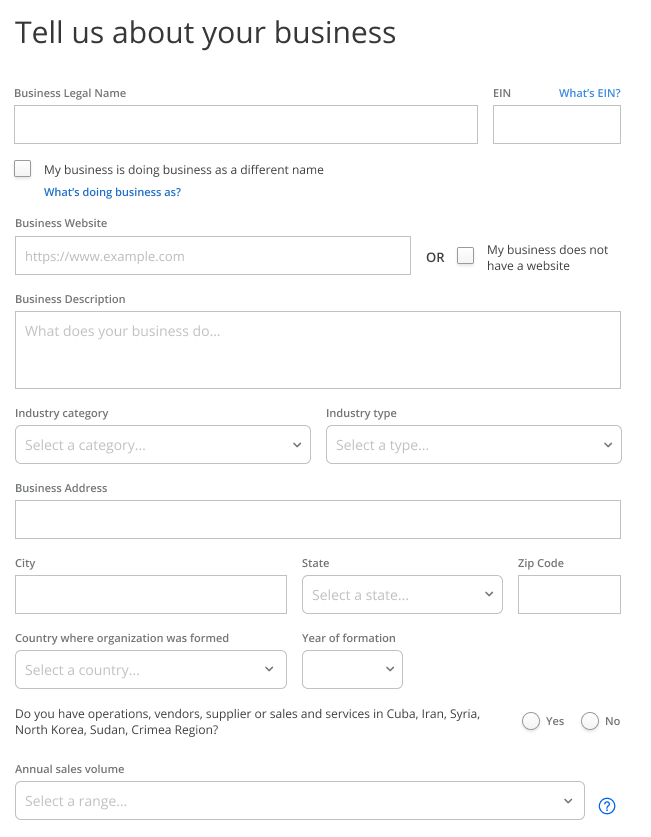

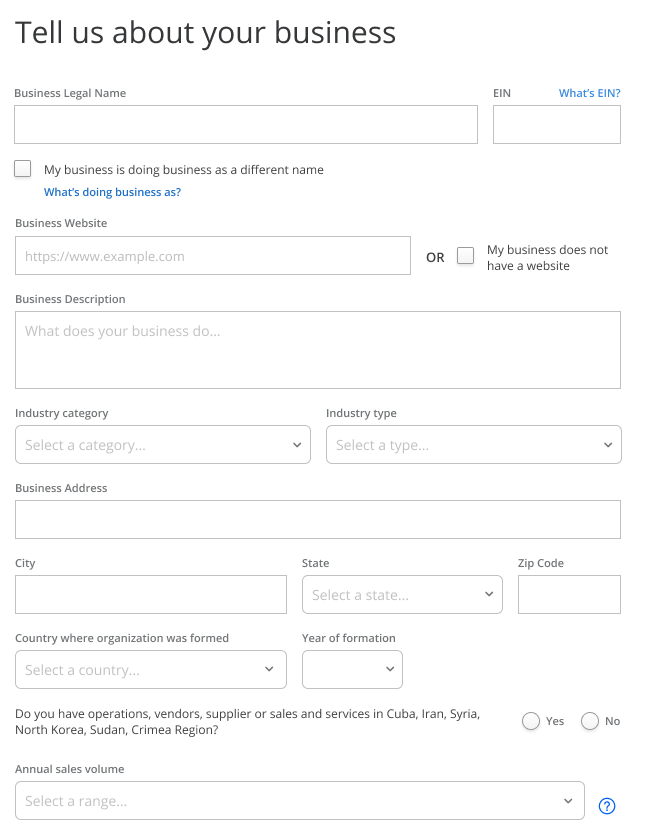

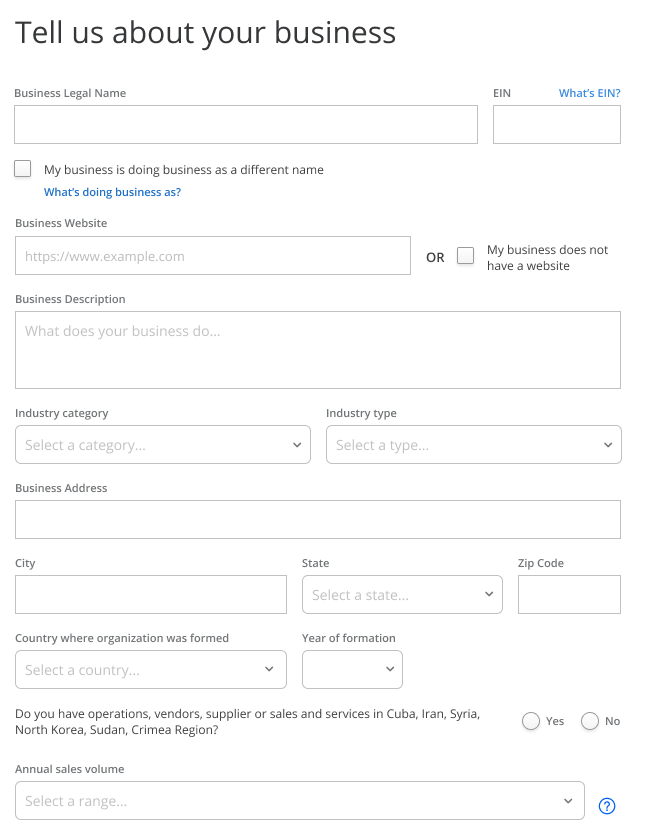

Your platform must request merchants to provide its website, if applicable. If the merchant does not have a website, the merchant should be required to confirm it does not have one. See example below:

Once collected, send the website on aPOST /legal_entities or POST /legal_entities/id API request in the top level primary_url parameter.Merchant Phone Number

Your platform must require the merchant to provide the phone number for its business.Exception: A business phone number is not required for entity types

individual or sole proprietor.Once collected, send the phone number on a POST /legal_entities or POST /legal_entities/id API request in the top level phone parameter.Controller Information

Each merchant must provide information about individuals that control the business. For entity typesindividual or sole proprietor, this is the merchant themselves. For Government Entities and any other entity type which is Publicly Traded (including subsidiaries), there will be an account controller who is an individual authorized to control the account. Account controllers do not need to provide all the details required of controllers. For all other entity types (i.e., not an individual, sole proprietor, government entity, or publicly traded company), a merchant has a controller. The legal definition of controller is a single individual with significant responsibility to control, manage, or direct a legal entity such as an executive officer, senior manager or other individual who regularly performs similar control functions. For the sake of simplicity, WePay uses the term "controller" in developer documents to refer to both merchants themselves (in the case of individuals or sole proprietors) as well as the controllers of all other entity types, as the requirements are similar in most part.When laying out the user interface, you the platform must provide users with the legal definition of a controller as a tool tip or similar informational display, so that merchants are informed of the information they must provide. Remember, the legal definition of a controller is: a single individual with significant responsibility to control, manage, or direct a legal entity such as an executive officer, senior manager or other individual who regularly performs similar control functions.

The following information must be collected from a controller, and must be submitted via the associated parameters on aPOST /legal_entities or a POST /legal_entities/id API request:| Information to collect | Associated parameters |

|---|---|

| Full Name | controller.name |

| Job title: Some examples of different titles for a controller are: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Managing Member, General Partner, President, Vice President, or Treasurer. Note: While platforms can have a drop-down menu with these titles, the platform must also provide an option for “Other” and accompanying free-form text field so merchant can provide any other titles. While platforms can have a drop-down menu with these titles, the platform must also provide an option for “Other” and accompanying free-form text field so merchant can provide any other titles. Exception: Job title is not applicable for entity types 'individual', ‘sole proprietors', 'government entities', or any publicly traded company (including subsidiaries). | controller.job_title |

| Full Residential Address | controller.address |

| Phone number | controller.phone |

| Date of birth (month, day, year) Note: This data is not required for account controllers of government entities or publicly traded companies (including subsidiaries) | controller.date_of_birth |

| SSN (US only). Generally, the merchant is only required to enter the last 4 digits of the SSN (SSN4) of the required person. Note a couple exceptions: 1. For entity type sole proprietor, if the merchant provides an EIN, the merchant must enter SSN4. If the merchant does not provide an EIN, the merchant must enter SSN9.2. If in any case SSN9 cannot be derived from the provided SSN4, the merchant must enter SSN9. Note: This data is not required for account controllers of government entities or publicly traded companies (including subsidiaries) | controller.personal_country_info.US.social_security_number controller.personal_country_info.US.social_security_number_last_four |

| SIN (Canada only -- optional) Note: This data is not required for account controllers of government entities or publicly traded companies | controller.personal_country_info.CA.social_insurance_number |

Beneficial Owner Information

For entity typescorporation, limited_liability_company, and partnership in the U.S. which are not publicly traded companies (including subsidiaries), your platform must collect certain information about beneficial owners of the merchant. The regulatory definition of a beneficial owner is someone who owns 25% or more of the merchant's equity. Controllers can be a beneficial owner, and platform must provide merchants an option for controllers to select themselves as a beneficial owner. In any case, there cannot be more than four 'beneficial owners' of a business.Since nonprofit organizations do not have owners or equity, there are no beneficial owners for nonprofits. Sole proprietors are 100% owned by the merchant, so there are no additional 'beneficial owners'.

The following information must be collected from each beneficial owner, and must be submitted via the associated parameters:

| Information to collect | Associated parameters |

|---|---|

| Full Name | additional_representatives.representative_X.name |

| Full Residential Address | additional_representatives.representative_X.address |

| Phone number | additional_representatives.representative_X.phone |

| Date of birth (month, day, year) | additional_representatives.representative_X.date_of_birth |

| SSN (US only) Generally, the merchant is only required to enter the last 4 digits of the SSN (SSN4) of beneficial owners. If SSN9 cannot be derived from the provided SSN4, the merchant must enter SSN9. | additional_representatives.representative_X.personal_country_info.US.social_security_number additional_representatives.representative_X.personal_country_info.US.social_security_number_last_four |

| SIN (Canada only --optional) | additional_representatives.representative_X.personal_country_info.CA.social_insurance_number |

Note: Canadian SIN is optional.

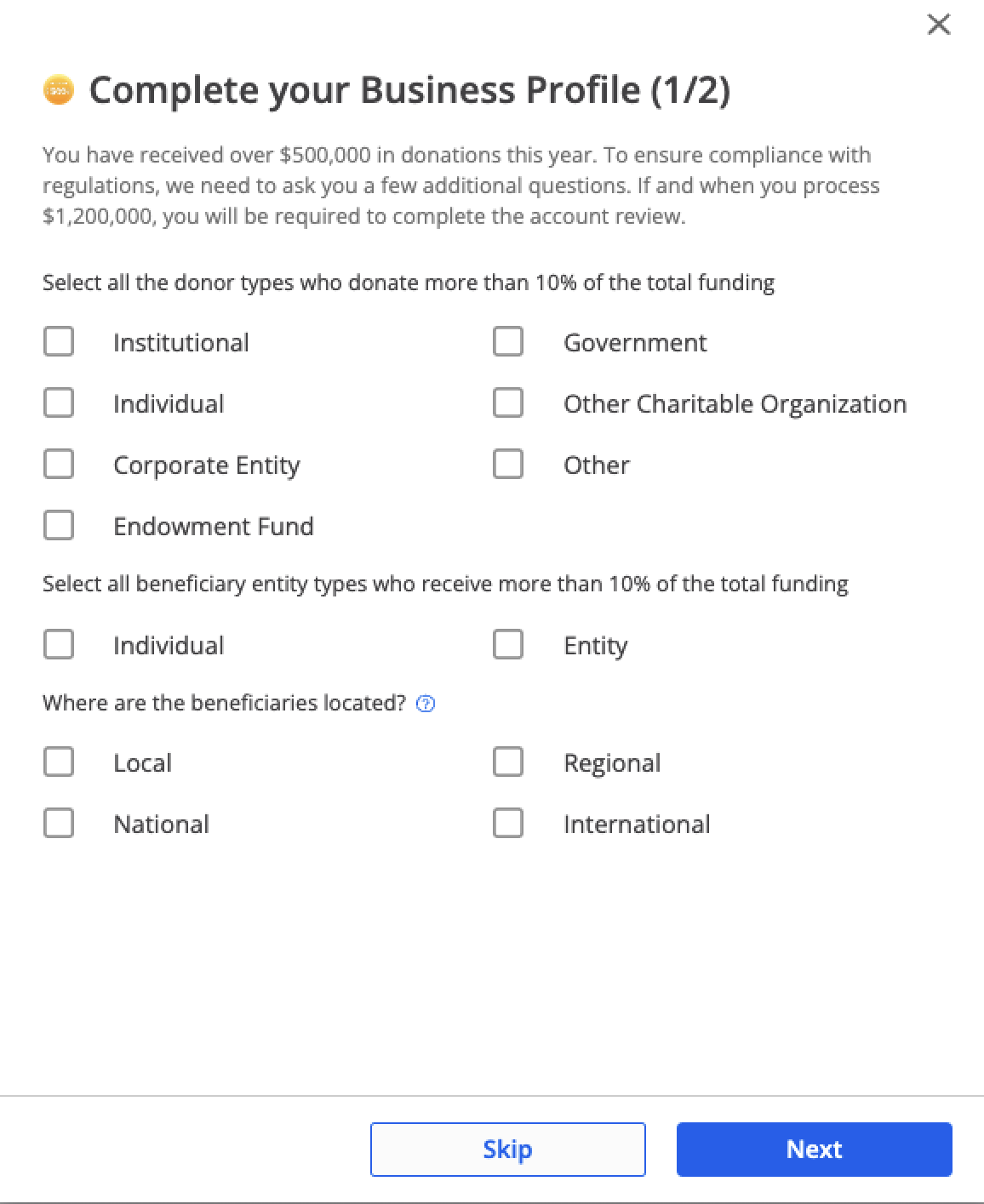

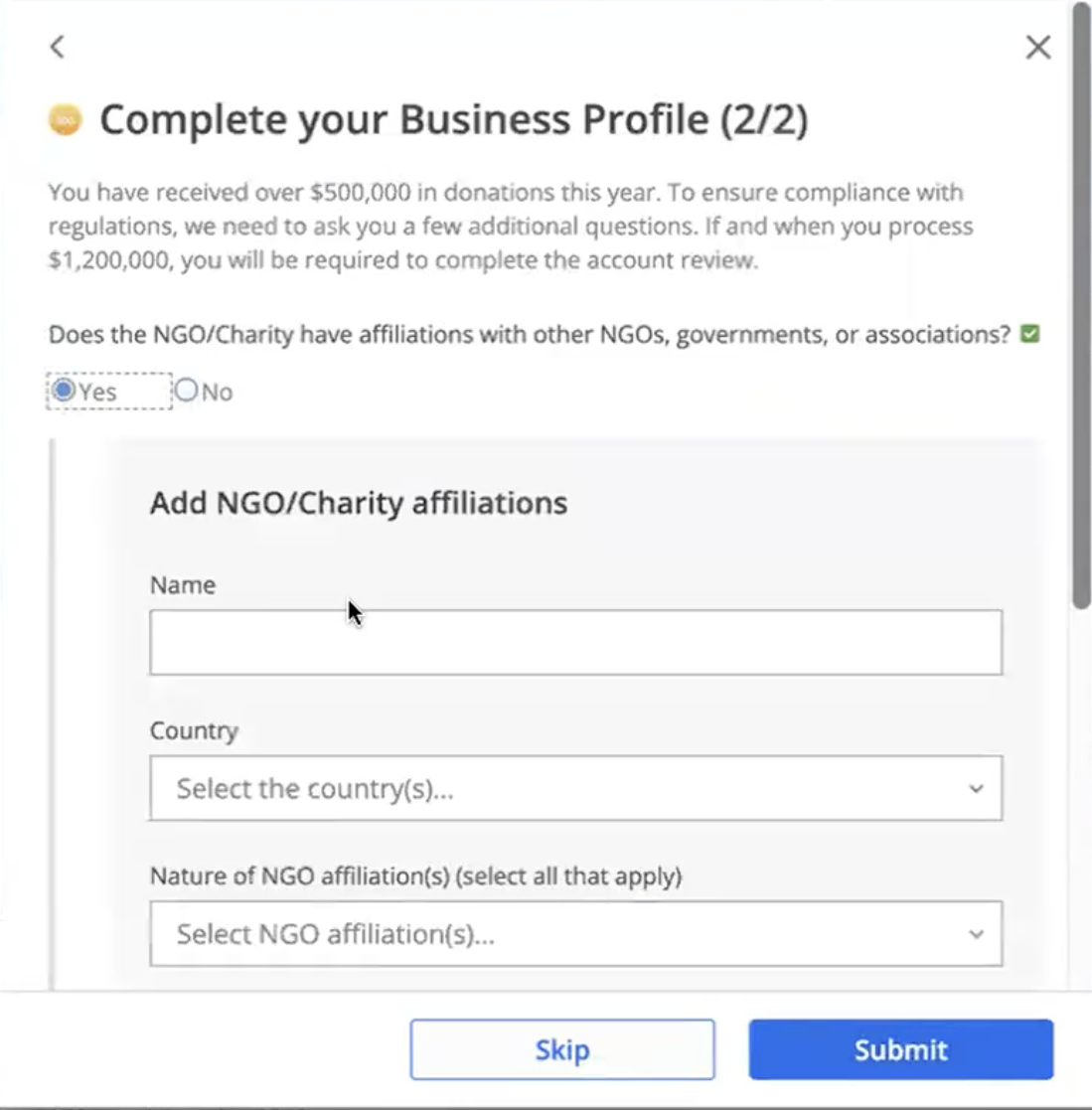

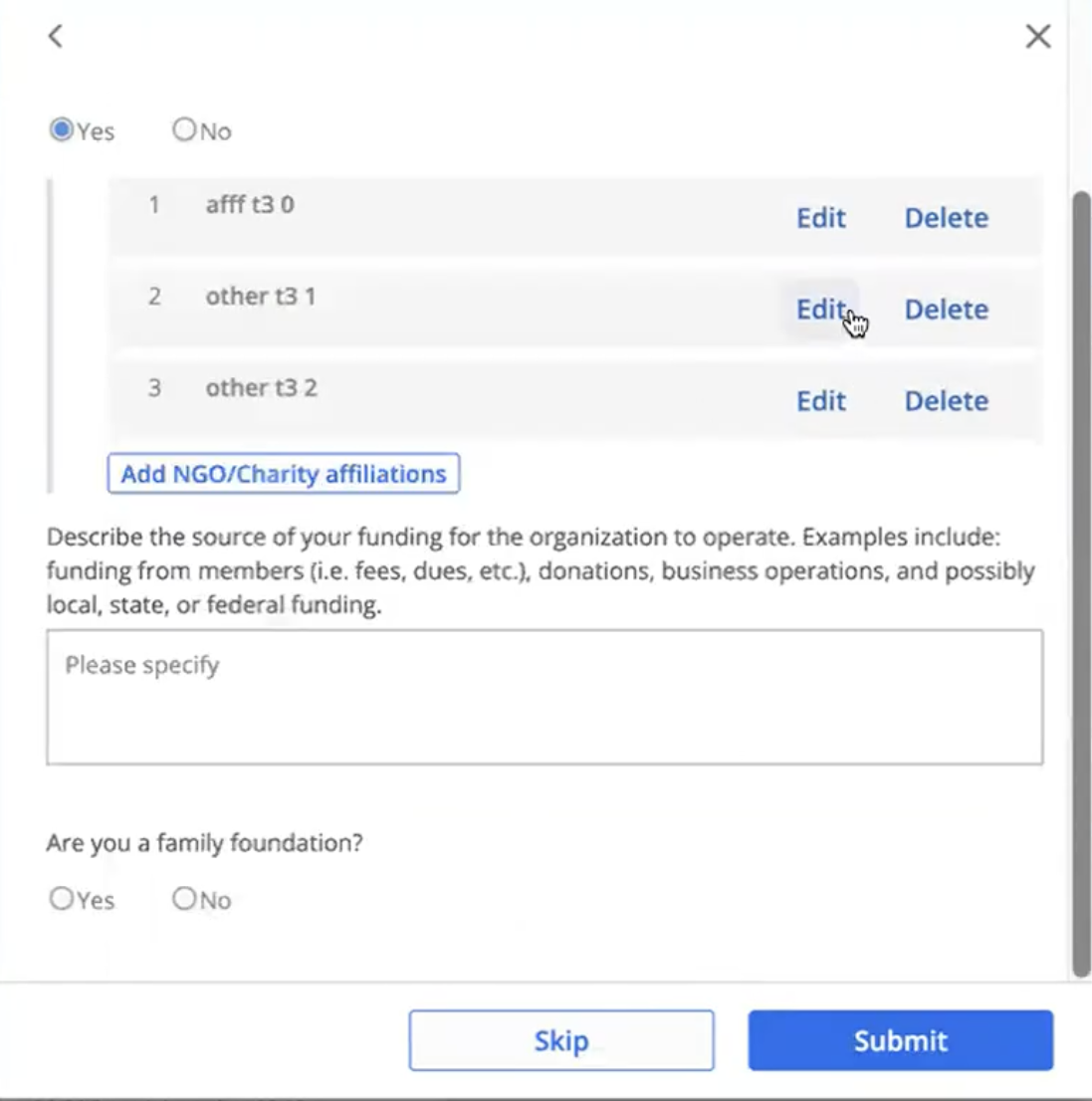

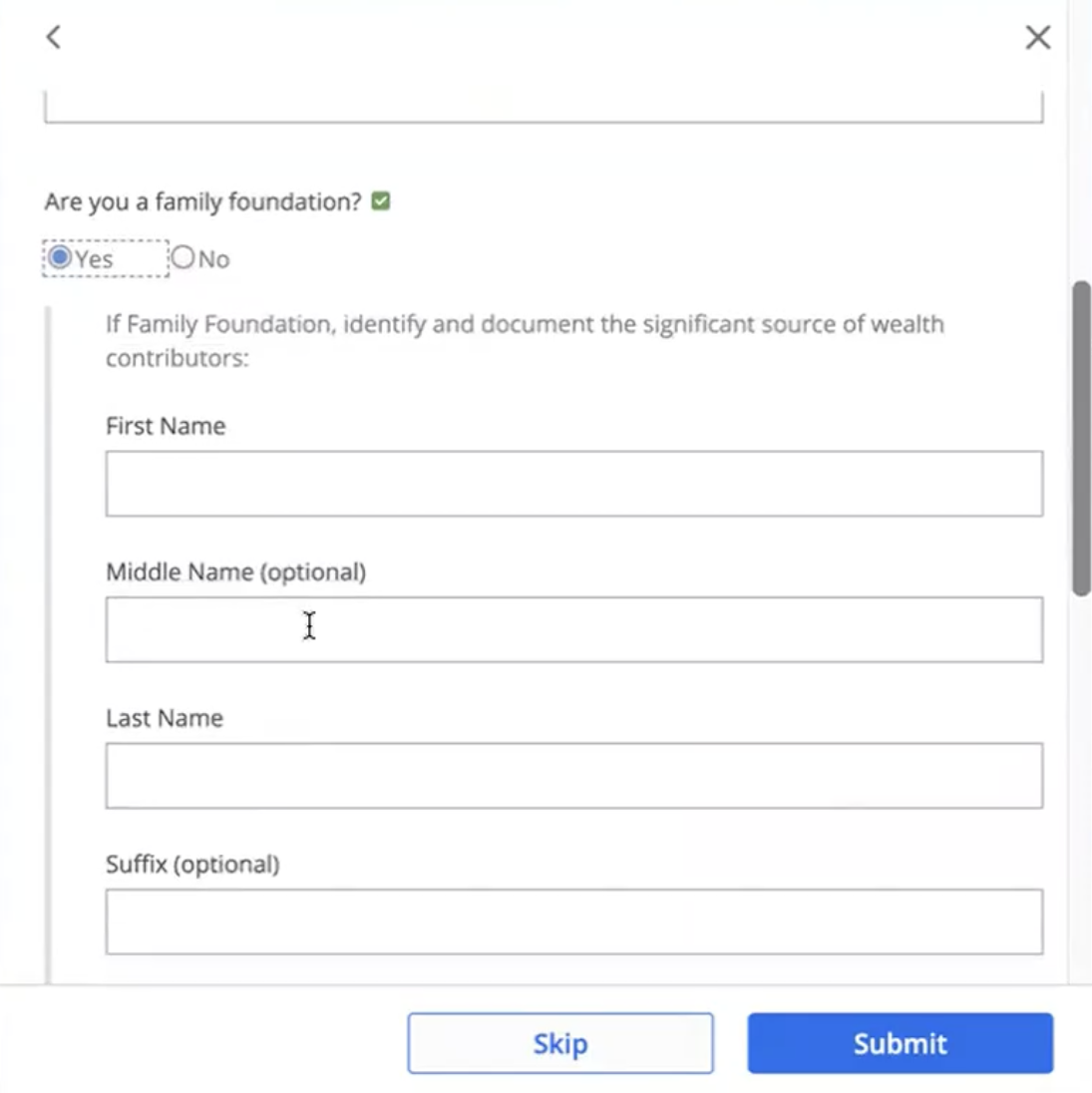

Verify High Volume NGOs and Charities

When an entity has the legal form of eitherunincorporated_association or nonprofit_corporation, and processes $1.2 million or more in a rolling 12-month period, they are considered high volume and we require additional information. If the legal entity has multiple Accounts, then the volume threshold ($1.2 Million) is calculated across all of those Accounts. The

trigger_status field of the legal_entities.tpv_threshold_reached Notification will fire at the respective Total Processing Time (TPV) triggers of $500K, $1M, and $1.2M. Note that there will be no changes to your capabilities at the first_trigger and second_trigger.We recommend sending emails (samples here), once receiving Notifications from WePay:

first_trigger: Account has processed $500,000.00 in a rolling 12-month window. Platform to email merchant, providing context for additional verification, and allow them to submit information.second_trigger: Account has processed $1,000,000.00 in a rolling 12-month window. Platform to email merchant, reiterating the required verification & that they are approaching the threshold, and allow them to submit information.third_trigger: Account has processed $1,200,000.00 in a rolling 12-month window for the first time. Platform to email merchant, indicating that additional verification is now required, and direct them to your platform for submission.

payouts.current_issues.errant_fields block of accounts.capabilities.updated Notification will specify the below parameters being needed. If information isn't provided by the $1.2M threshold, payout capabilities are disabled. If, after 30 days, the information isn't provided, incoming payments will be disabled.The information is all provided to the Legal Entity resource. Note that once the additional information is provided once, it will not need to be provided again.

| Detail | Parameter(s) | Notes |

|---|---|---|

| Significant beneficiaries' affiliates | significant_beneficiaries.affiliations | Specifies a list of affiliated Non Profit organizations to merchants. Multiple affiliations, countries of affiliations, and association types are allowed. |

| Significant beneficiaries' location | significant_beneficiaries.geographies | A significant beneficiary is any person or entity who receives or controls 10% or more of the funds being collected. For geographies, all values are allowed, and if specifying international, multiple countries allowed. |

| Significant beneficiaries' entity type | significant_beneficiaries.entities | Specifies the type of entities of significant beneficiaries - multiple selections allowed. |

| Significant donors' entity type | significant_donors | A significant donor is any person or entity who contributes 10% or more of the organization's total volume. |

| Entity Purpose or Ideology | entity_purpose_or_ideology | Specifies the purpose or ideology of the organization. |

| Entity Source and Use of Funds | source_and_use_of_funds | Specifies the information about the source and use of organization's funds. |

| Indicator if Entity has significant wealth contributors | has_significant_wealth_contributors | Indicates [True/False] if there are possible significant wealth contributors to the organization. A significant wealth contributor is any person or entity who contributes 10% or more to the organization's funding, also known as investors. Note: This field is only required if the entity_purpose_or_ideology is Family Foundation. |

| Significant wealth contributors | significant_wealth_contributors | Information of up to 10 significant wealth contributors to the organization. A significant wealth contributor is any person or entity who contributes 10% or more to the organization's funding, also known as investors. Note: This field is only required if the entity_purpose_or_ideology is Family Foundation. |

Here is a preview of how your platform can use the API endpoints above to collect information from high volume NGO's and Charities:

Publicly Traded Status

Entities that are corporations, limited liability companies, or partnerships can be publicly traded. Publicly Traded Companies (including subsidiaries) should provide account controller, not controller, information.

The following information must be collected to indicate Publicly Traded status:

| Information to collect | Associated parameters |

|---|---|

| Is the merchant traded on the New York Stock Exchange, American Stock Exchange, or the NASDAQ as a NASDAQ National Market Security? Note: Subsidiaries should respond with false | public_ownership.is_publicly_traded |

| Select the stock exchange(s) your company is traded on Note: Subsidiaries should provide the exchange of their parent company | public_ownership.traded_exchanges.NYSE/AMEX/NASDAQ |

| Provide your ticker symbol on each exchange Note: Subsidiaries should provide the ticker symbol(s) of their parent company | public_ownership.traded_exchanges.NYSE/AMEX/NASDAQ.symbol |

| Is the merchant a subsidiary of a publicly traded company? | public_ownership.is_subsidiary |

| If so, provide the legal name of the parent company | public_ownership.parent_company_name |

Sample KYC UIs

Find samples of how KYC is presented differently depending on a merchant'slegal_form. As a note, all of WePay's KYC UIs provide a method for the merchant to select their MCC based on the industry description which best describes their account.All merchants will begin by providing information on their industry, sales volume, and transaction information, as shown here:

legal_form, as shown here:legal_form requirements for that selection:Sole Proprietor KYC UI

Provide the legal definition of "Sole Proprietor" to help users select the best

legal_form for their account:Collect information about the business. EIN is optional as some Sole Proprietors operate using the individual's social security number:

Collect the Sole Proprietor's personal verification details. These will be the controller details, and there will not be any beneficial owners of a Sole Proprietor. If they have provided an EIN, then only the last 4 digits of their social security number are required; otherwise all 9 digits are required.

Business (Partnership) KYC UI

Provide an explanation of a legal business partnership.

Collect the partnership's entity information.

Collect the personal information for the partnership's controller. The controller must disclose whether they have 25% or more equity in the partnership.

Collect the personal information for all individuals who own 25% or more equity in the partnership.

Business (LLC) KYC UI

Identify why a user would select the LLC entity type to describe their account.

Collect the LLC's entity information.

Collect the personal information for the LLC's controller. The controller must disclose whether they have 25% or more equity in the LLC.

Collect the personal information for all individuals who own 25% or more equity in the LLC.

Business (Corporation) KYC UI

Identify why a user would select the corporation entity type to describe their account.

Collect the corporation's entity information.

Collect the personal information for the corporation's controller. The controller must disclose whether they have 25% or more equity in the corporation.

Collect the personal information for all individuals who own 25% or more equity in the corporation.

Nonprofit (Nonprofit Corporation) KYC UI

Identify why a user would select the nonprofit corporation entity type to describe their account.

Collect the nonprofit corporation's entity information.

Collect the personal information for the nonprofit corporation's controller.

Nonprofit (Unincorporated Association) KYC UI

Identify why a user would select the nonprofit unincorporated association entity type to describe their account.

Collect the nonprofit unincorporated association's entity information.

Collect the personal information for the nonprofit unincorporated association's controller.

| Event | Beneficial Ownership Certification Required | Action | Explanation |

|---|---|---|---|

| New to Bank Non-Exempt Customer | Yes. Certification must be obtained in writing. | Certification for each new account must be obtained via ToS acceptance during on-boarding at the time of account opening (current state) and through certification acceptance language in KYC flow (future state). To obtain certification in writing, you must make sure the call to Legal Entities passes timestamp and I.P. address. | The FinCEN CDD Rule requires that beneficial ownership information be collected, verified and certified at the time of each new account opening. |

| Existing Non-Exempt Customer: New Non-Exempt Account Opening | Initial certification must be obtained in writing. Subsequent certification must be obtained either verbally or in writing. | Certification for each new account must be obtained via ToS acceptance during on-boarding at the time of account opening (current state) and through certification acceptance language in KYC flow (future state). To obtain certification in writing, you must make sure the call to Legal Entities passes timestamp and I.P. address. | The FinCEN CDD Rule requires that beneficial ownership information be collected, verified and certified at the time of each new account opening. Where a financial institution has previously obtained a certification form for the beneficial owners(s) of the legal entity customer, the customer must certify verbally or in writing that the information provided previously is up-to-date and accurate at the time each subsequent account is opened. |

Attestation

In addition to simply collecting the elements described above, federal regulations require that the person certify to the completeness and accuracy of the information provided. Traditionally, this requirement is fulfilled by including a specific attestation language and obtaining signature on the same form used to collect identity information.

Note: This attestation should be included not only when the identity information is submitted for the first time, but also when identity information is subsequently updated.

In a digital setting, this requirement can be fulfilled by including attestation language in the same user experience used to collect identity information and obtaining the electronic equivalent of a signature - timestamp, IP address, user name (or any other ID). Sample attestation language is provided here:

| Event | Proactive Review of Beneficial Ownership Required? | Proactive Review of exemption Status Required? | Beneficial Ownership Certification Required? | Action |

|---|---|---|---|---|

| Existing merchant with KYC update, and no change in Beneficial Ownership Information1 or CDD Rule Exemption Status identified. | No | No | No | No action required. |

| Existing merchant with KYC update, but change in Beneficial Ownership Information1 or CDD Rule Exemption Status Identified | Yes | Yes | Yes | Subsequent Certification must be obtained via ToS re-acceptance (current state) and through certification acceptance language in KYC flow (future state). |

“By clicking "Submit," you hereby certify, to the best of your knowledge, that the information provided above is complete and correct.”

As an example, WePay provides this language in the embedded and hosted KYC flow:

The attestation language must be located right above the “submit” button.

Updates to Identity Information

If your platform would like to provide merchants with a seamless way to update their identity information, keep in mind a couple requirements:

- First, if any controller or beneficial ownership information is being updated, your platform must provide the merchant with a review of all details submitted for controllers and beneficial owners (including unchanged information and information that is being updated) for confirmation before submission. Note: For security reasons, your platform should not display any SSN or date of birth in this review.

- Second, as stated above in Attestation, you must require the merchant to certify that the information provided is accurate.

Note that any changes to identity or entity information may result in another review by WePay to verify the updated details.

To update a Legal Entity's information, first send aPOST /legal_entities/id request targeting the relevant details and setting the value(s) to null. For instance, if a controller is updating their residential address, send the following:curl -X POST \

--url 'https://stage-api.wepay.com/legal_entities/id' \

-H 'App-Id: 12121'\

-H 'App-Token: stage_BGDS9205HGGQ4LWIzOWYtNGU0Yy1iMTU4LTM4Zjg0YmYxODQzOA'\

-H 'Api-Version: 3.0'\

-H 'Content-Type: application/json' \

--data-raw '{

"controller": {

"address": {

null

}

}

}'Certification Checklist

In summary, you must provide, and will only be certified after you provide:

- UIs providing the complete list of entity types for your merchants to select from

- UIs for collecting the correct identification numbers (e.g., EIN or Business Number) from each merchant based on entity type and country

- UIs for all required merchant information fields

- UIs for all required controller information fields for all entity types except individuals and sole proprietors

- UIs for all required beneficial owner fields for all entity types except individuals, sole proprietors, and nonprofits

- UIs to collect attestation from the merchant

- UIs to update merchant identity information

Clear

Clear Link

Link